Find Out 27+ List On Unusual And Infrequent Gains And Losses Your Friends Missed to Tell You.

Unusual And Infrequent Gains And Losses | Even though such items affect net income from continuing operations, an. Companies that have unusual or infrequent gains and losses are required to group of answer choices disclose this info in the income statement disclose this info in the notes to the financial statement disclose this info in the income statement or in notes to the financial statement. They must be reported separately (below the line) net of income tax. .or infrequent items include gains or losses from a lawsuit; Discontinued application of specialized accounting for regulated operations.

A prior period adjustment on the statement of retained earnings. Gains and losses on extinguishment (redemption) of debt obligations. Exchange gains and losses are included in the income statement. • gains or losses on sale of investment securities. unusual or infrequent but not both questions to consider… what is the business environment?

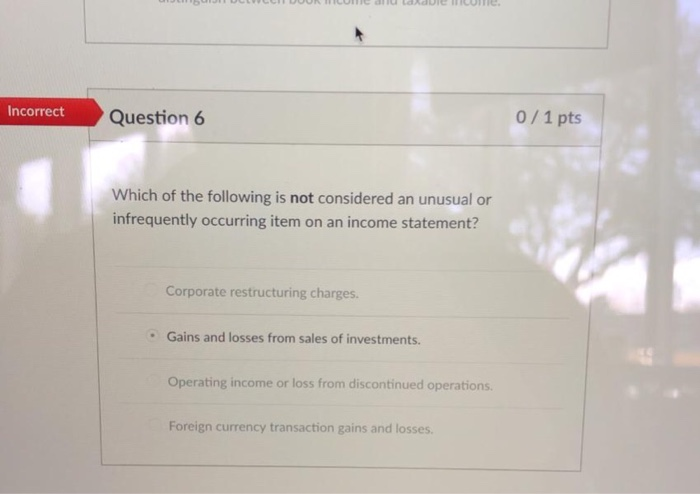

Unusual gains and losses are unforeseen and dont occur often not just to your company but companies in the same industry as you ie broken rollercoasters at an amusement parks are not. Gains or it also helps reduce uncertainty for auditors and regulators who previously had to determine whether a preparer treated an unusual and/or infrequent. • gains or losses on sale of investment securities. Gains (losses) from the sale of the company's assets, business segments. Extraordinary gains and lossesno pun intended, but these types of gains and losses are extraordinarily important to understand. Infrequent and unusual are synonymous, and they have mutual synonyms. These are usually explained further in the notes to the financial statements. Companies that have unusual or infrequent gains and losses are required to group of answer choices disclose this info in the income statement disclose this info in the notes to the financial statement disclose this info in the income statement or in notes to the financial statement. unusual or infrequent but not both questions to consider… what is the business environment? Examples of unusual or infrequent items include: The following study surveys more than 16,000 public companies' financial. How do you adjust the exchange gain/loss at the time of capitalization of any asset if it is purchased in other than local currency? Quent gains and losses a.

• gains or losses from the disposal of a business segment (employee separation costs, plant shutdown costs, etc.) • gains or losses from the sale of assets or investments in subsidiaries • provisions for environmental remediation • impairments. Are reported net of tax. How do you adjust the exchange gain/loss at the time of capitalization of any asset if it is purchased in other than local currency? • gains or losses on sale of investment securities. You can use infrequent instead the word unusual as an adjective or a verb, if it concerns topics such as frequency, scarce.

A gain or loss from disposing of the discontinued segment's net assets. The following study surveys more than 16,000 public companies' financial. • gains or losses from the disposal of a business segment (employee separation costs, plant shutdown costs, etc.) • gains or losses from the sale of assets or investments in subsidiaries • provisions for environmental remediation • impairments. This way users of the financial statements see that it could be a frequent event, but it most likely will not happen regularly. Exchange gains and losses are included in the income statement. Quent gains and losses a. Include the elimination of a component of the business. A gain or loss from disposing of the discontinued segment's net assets. A prior period adjustment on the statement of retained earnings. Examples of unusual or infrequent items include: If the unusual gain or loss is only unusual and not infrequent, it should be reported in the continuing operations section after the normal revenues and expenses. Even though such items affect net income from continuing operations, an. Unusual or infrequent items are included in income from continuing operations and are reported before tax.

The following are a number of unusual and/or infrequent gains or losses that might be disclosed on. It is sometimes necessary to hang a man, villains often deserve. Unusual or infrequent items are transactions that are unusual in nature or infrequent, but not both (exhibit 5.6). If not unusual and infrequent, it remains in the main section of the income statement. Infrequent and unusual are synonymous, and they have mutual synonyms.

Gains and losses on extinguishment (redemption) of debt obligations. • gains or losses from the disposal of a business segment (employee separation costs, plant shutdown costs, etc.) • gains or losses from the sale of assets or investments in subsidiaries • provisions for environmental remediation • impairments. For example, gains and losses from disposal of fixed assets or changes in inventory unusual items affect the net income calculation on the income statement, including resulting in a loss. Unusual gains and losses n. Even though such items affect net income from continuing operations, an. The following are a number of unusual and/or infrequent gains or losses that might be disclosed on. How do you adjust the exchange gain/loss at the time of capitalization of any asset if it is purchased in other than local currency? Therefore, the criterion of unusual nature has not been met and the moving expenses (and related gains and losses) should not be reported as an extraordinary item. Companies that have unusual or infrequent gains and losses are required to group of answer choices disclose this info in the income statement disclose this info in the notes to the financial statement disclose this info in the income statement or in notes to the financial statement. Unusual and infrequent material gains and losses. Examples of unusual or infrequent items include: Les gains et perte de change sont présentés dans l'état des résultats d'exploitation. Gains or losses on disposal of a component of an entity d.

Unusual And Infrequent Gains And Losses: These are usually explained further in the notes to the financial statements.

0 Response to "Find Out 27+ List On Unusual And Infrequent Gains And Losses Your Friends Missed to Tell You."

Post a Comment